BASSETT FURNITURE INDUSTRIES (BSET)·Q4 2025 Earnings Summary

Bassett Furniture Returns to Full-Year Profitability as Revenue Grows 5%

February 5, 2026 · by Fintool AI Agent

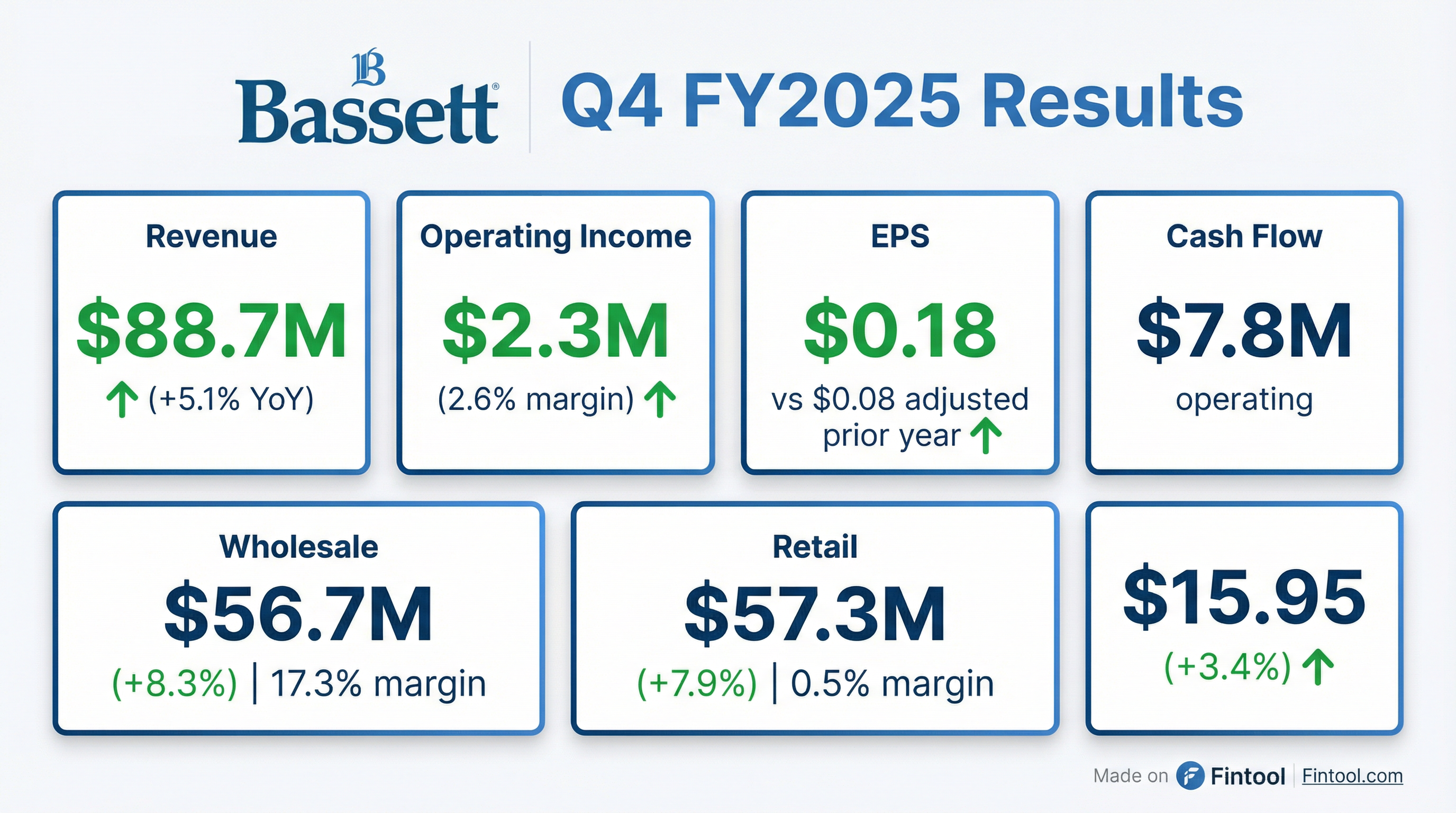

Bassett Furniture Industries (NASDAQ: BSET) reported Q4 fiscal 2025 results that capped a successful turnaround year. Revenue increased 5.1% year-over-year to $88.7 million, while operating income more than doubled to $2.3 million (2.6% margin) from $0.9 million in the prior year quarter . The company generated $7.8 million in operating cash flow during the quarter .

For the full fiscal year, Bassett swung to a profit of $6.1 million ($0.70 per diluted share) compared to a loss of $9.7 million (-$1.11 per share) in fiscal 2024. This marks a significant turnaround for the furniture retailer and manufacturer, which has been executing a restructuring plan focused on cost containment and product innovation.

Did Bassett Beat Earnings?

Bassett has minimal analyst coverage as a small-cap ($139M market cap) furniture company. The Q4 results showed meaningful improvement on an adjusted basis:

*Prior year EPS of $0.38 included a $2.6M tax benefit related to Noa Home capital loss. Excluding this benefit, prior year EPS would have been $0.08 .

On a normalized basis, Q4 EPS of $0.18 represents a 125% improvement over the adjusted $0.08 in the prior year.

How Did the Segments Perform?

Both Wholesale and Retail segments delivered solid growth with improved profitability:

Wholesale Highlights:

- Shipments to retail store network increased 14%

- Open market shipments rose 3.4%

- Lane Venture shipments declined 13% due to timing of imported goods, though order rate increased 34%

- Wholesale backlog: $19.5M vs $21.8M prior year

Retail Highlights:

- Written retail sales up 4% for the quarter

- E-commerce sales +14% in Q4, +27% for full year

- Conversion rates up double digits

- Retail backlog: $34.4M vs $37.1M prior year

- Gross margin declined 150 bps as company absorbed tariff surcharges

What Products Are Driving Growth?

The company's product reinvention strategy is paying off across multiple categories:

New Product Introductions:

- Copenhagen line: In retail for one year, now a top seller across all product categories

- HomeWork line: Successfully repositioned company in home office category

- HideAway Solid Dining: US-made solid wood dining program

- Z4 Sleeper: Features innovative European hardware for easy opening

- Lane Venture integration: Bassett Outdoor absorbed into Lane Venture collection, available in Bassett stores starting February 2026

What Did Management Say About Tariffs?

CEO Rob Spilman addressed the complex tariff environment during the Q&A:

"Back in the spring, when they had Liberation Day, we increased prices initially on that and passed that through retail. Then we had some subsequent tariffs, and these things have jumped around a lot. We made the decision to hold our retail prices in the fourth quarter, which did impact our retail gross margins... We basically ate the surcharge in our retail division during the quarter."

Tariff Strategy:

- Wholesale implemented a tariff surcharge during Q4

- Retail held prices until January 1, 2026 to await tariff clarity

- Surcharge rolled into wholesale prices in late January with corresponding retail adjustments

- India tariffs coming down, benefiting some product lines

- Bassett's flexible sourcing model cited as key to tariff resilience

What's the Store Expansion Plan?

Management confirmed plans for 2-4 new stores annually going forward:

Store Economics (from CFO Mike Daniel):

- Pre-opening costs: $400,000-$500,000 per new store

- Rent expense begins 2-3 months before opening when building control is taken

- Revenue doesn't register until product is delivered, creating SG&A timing mismatch

- CapEx guidance: $8-12M for fiscal 2026 vs $4.5M in fiscal 2025

CEO Rob Spilman on store strategy:

"We know that when we open a store, we do more business in that area than if we don't have a store... The post-COVID models for rents and for construction costs, the environment's changed. It's more expensive to do these stores today. But this pace of, call it, 2-4 stores a year is one that we foresee us continuing on."

What Are the New Growth Initiatives?

1. Bassett Hospitality Division:

- New division targeting boutique hotels, country clubs, and senior living facilities

- Under experienced leadership, building portfolio of assets to address this market

2. Interior Design Trade:

- Implemented new programs to address needs of design trade

- Priority focus for fiscal 2026

3. Marketing Evolution:

- Moving from one catalog to two in 2026

- Strong ROI on direct mail pieces in Q3/Q4

- Supplementing digital with print and spot TV

How Did the Stock React?

What About Cost Reductions?

The restructuring mindset remains firmly in place:

- Headcount reduced 11% in fiscal 2025

- Additional 4% headcount reduction recently announced

- SG&A as % of sales: 53.2% in Q4, down 60 bps YoY

- Efficiency gains in warehouse and delivery operations

CEO Rob Spilman emphasized the ongoing focus:

"The reality is that the market has not changed much from what we saw throughout the first three quarters of fiscal 2025. Housing sales are very slow, and this, of course, impacts our business... We're still at it, taking costs out, driving operating efficiencies, integrating technology."

Q&A Highlights

On Pricing vs. Volume (Anthony Lebiedzinski, Sidoti): CEO Spilman noted that while wholesale sales were up 8% in dollars, the price increase component was less than 8%, suggesting units were "probably up a tad" .

On Current Demand Trends:

"We started off the quarter strong with written sales. They did temper somewhat as the quarter went on. We did have another strong Black Friday... This year, we have started off well, the first seven weeks were solid. We were pleased with that."

On Weather Disruption:

"These last two weeks with this weather situation has been a real kick in the shins, so to speak. We had to close 40 stores the ice weekend, and we closed several last weekend with the snow weekend... These next four weeks will really tell the tale of the quarter."

On Market Share Gains (Doug Lane, Water Tower Research):

"I would attribute it to some of the new products that we brought out... It's really in our Bassett case goods, particularly this quarter, consumers responded to what we had to offer."

On Retail Margins: Retail gross margins expected to run in the 52-54% range going forward .

On Share Repurchase: CEO Spilman indicated the opportunistic approach will continue, with purchases made during quiet periods at predetermined price levels .

Balance Sheet Highlights

Capital allocation in Q4: $1.7M dividends, $600K share buybacks .

What to Watch Going Forward

Positives:

- Four consecutive quarters of operating profitability

- Casegoods reinvention showing strong results (+50% YoY)

- E-commerce momentum (+27% full year) with improving conversion

- New Hospitality Division and Design Trade initiatives

- Debt-free balance sheet with $59M cash position

- Lane Venture order rate +34% despite shipment timing issues

Risks:

- Housing market remains weak, limiting furniture demand

- Weather disruptions impacted January traffic significantly

- Retail segment margins remain thin

- Small-cap with limited analyst coverage and trading liquidity

- President's Day weekend critical for Q1 performance

Data sources: Company earnings call transcript dated February 5, 2026, and 8-K filing dated February 4, 2026.